s corp tax calculator nj

This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Nonprofit and Exempt Organizations.

How Much Does A Small Business Pay In Taxes

What percent of equity do you own.

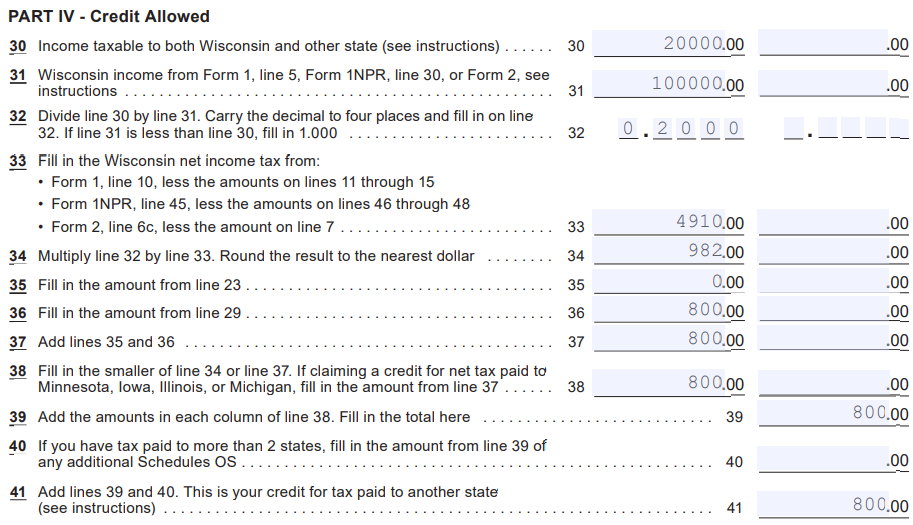

. 1895 Total Savings From S-corp Conversion 1895 2 Review the Costs to Convert to S-Corp Initial state. Check each option youd like to calculate for. For the election to be in effect for the current tax year the New Jersey S Corporation.

Pass-Through Business Alternative Income Tax PTE S Corporations Are Responsible for Payment Of New. Partnership Sole Proprietorship LLC. New jersey income tax calculator 2021.

General Instructions for New Jersey S Corporation Business Tax Return and Related Forms - 2 - 187-116a1 through a7 must file the New Jersey Corporation Business Tax Return for. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. For example if you.

21020 Annual Self Employment tax as an S-Corp 19125 You Save. In Bergen and Essex Counties west of New York. Licensed Professional Fees.

In nearly half of New Jerseys counties real estate taxes for the average homeowner are more than 8000 annually. Our calculator will estimate whether electing S corp will result in a tax win for your business. New jersey state tax quick facts.

The S Corporation tax calculator below lets you choose how much to withdraw from your business each year and how much of it you will take as salary with the rest being taken as a. Our S corp tax calculator will estimate whether electing an S corp will result in a tax win for your business. Determine a reasonable salary for the.

For taxpayers with Entire Net Income greater than 50000 and less than or equal to 100000 the tax rate is 75 075 on adjusted entire net income or such portion thereof as may be. A financial advisor in New Jersey can help you understand how taxes fit into your overall financial goals. Before using the S corp tax calculator you will need to.

Financial advisors can also help with investing and financial planning -. Before using the calculator you will need to. As noted above a new jersey s corporation pays a.

The SE tax rate for business owners is 153 tax. File a New Jersey S Corporation Election using the online SCORP application.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

State Corporate Income Tax Rates And Brackets Tax Foundation

Missouri Income Tax Rate And Brackets H R Block

How To Calculate Payroll Taxes Tips For Small Business Owners Article

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

When Are Taxes Due In 2022 Forbes Advisor

Estimated Quarterly Tax Payments Calculator Bench Accounting

Corporate Tax In The United States Wikipedia

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

S Corporation Tax Filing Benefits Deadlines And How To Bench Accounting

Use This S Corporation Tax Calculator To Estimate Taxes

Dor Pass Through Entity Level Tax Tax Option S Corporation Shareholder Reporting Questions

Tax Liability What It Is And How To Calculate It Bench Accounting

Llc Tax Calculator Definitive Small Business Tax Estimator

Llc And S Corporation Tax Tax Hack

S Corp Income Tax Rate What Is The S Corp Tax Rate